How to Check SBI Account Balance via Missed Call on Phone? Life gets busy, and checking your bank balance can sometimes feel like a chore. But what if you could check your SBI account balance in just a few seconds, without even having to log in or talk to anyone? Sounds like magic, right? Well, with SBI’s missed call service, it’s actually possible. You can get your account balance sent straight to your phone with just one quick missed call. No fuss, no hassle just instant access to your financial info.

The State Bank of India (SBI) offers a super convenient way to check your account balance via a missed call. Just give their number a ring, hang up before they answer, and you’ll get a text with your balance. Easy! Before dive into method of How to Check SBI Account Balance via Missed Call on Phone. Let’s know something about SBI and their services, benefits etc.

The State Bank of India (SBI)

State Bank of India (SBI) is a multinational public sector bank and financial services company headquartered in Mumbai, India. SBI is the largest bank in India with a 23% market share by assets and a 25% share of the total loan and deposits market. It is also the tenth largest employer in India with nearly 250,000 employees.

SBI has 22,542 branches and 63,580 ATMs across India and 241 overseas offices in 36 countries. SBI has been recognized as one of the world’s largest banks by assets and has received various awards for its banking services and corporate social responsibility initiatives.

First thing before checking SBI account balance via missed call on phone you have to make sure your mobile number is registered with your SBI account. If it’s not, you can update it at your nearest SBI branch or through their internet banking portal let me show you some methods to register your mobile number with your SBI account.

Method 1: Register Mobile Number SBI through SMS

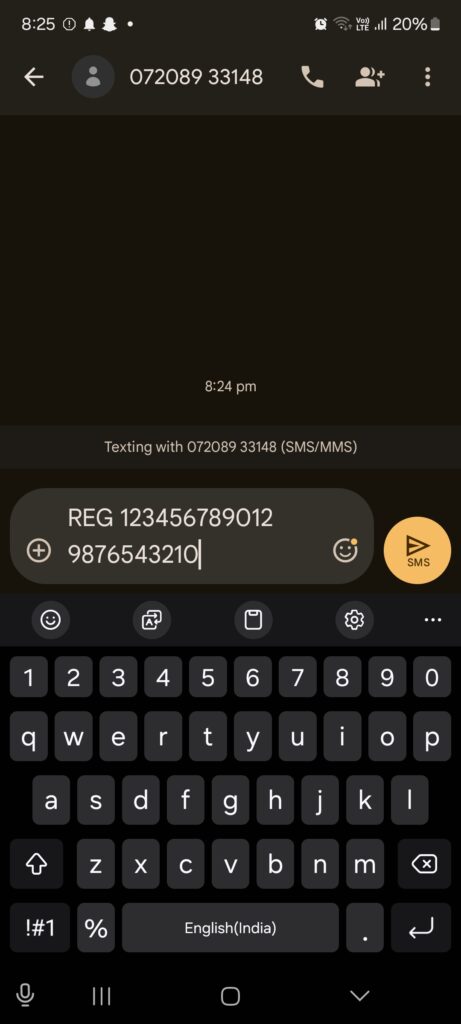

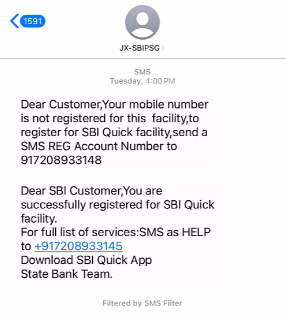

Send an SMS in the format REG space 12-digit Account Number space Your Mobile Number to 917208933148 or 09223488888 (check with SBI for the correct number). Example: If your account number is 123456789012 and your mobile number is 9876543210, the SMS would be REG 123456789012 9876543210.

After that you will receive a confirmation SMS from SBI once your mobile number is registered.

Method 2: Register Mobile Number through SBI Branch

- Visit your nearest SBI branch.

- Fill out the Mobile Number Registration Form (available at the branch).

- Provide your account details and mobile number.

- Submit the form along with your ID proof and account proof.

- The bank representative will update your mobile number in the system.

Method 3: Register Mobile Number through SBI Internet Banking

- Log in to your SBI Internet Banking account.

- Go to the Profile or Settings section.

- Click on Mobile Number Registration or Update Mobile Number.

- Enter your new mobile number and follow the prompts to complete the registration process.

Method 4: Register Mobile Number through SBI Customer Care

- Call SBI Customer Care number (1800 1234 or 1800 2100).

- Follow the automated prompts or speak to a customer care executive.

- Provide your account details and mobile number.

- The customer care executive will guide you through the registration process.

Method 5: Register Mobile Number through SBI ATM

- Visit your SBI ATM.

- Select Register Mobile Number or Update Mobile Number option.

- Follow the on-screen instructions and enter your mobile number.

- Confirm your mobile number and complete the registration process.

How to Check SBI Account Balance via Missed Call on Phone?

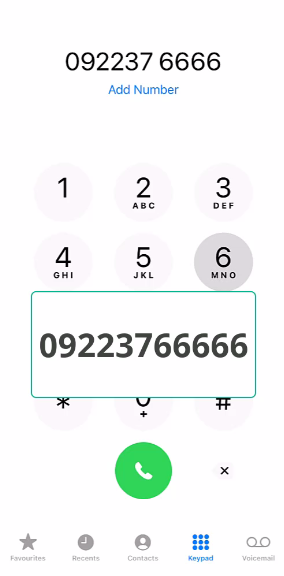

Step 1: Take your phone and dial 09223766666 from the number registered with your SBI account.

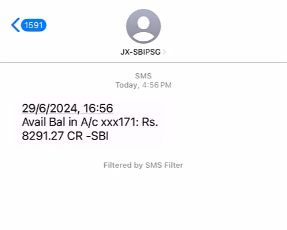

Step 2: Let it ring once or twice, and in one or two ring the call will be automatically end. Within a few seconds, you’ll receive a text message with your current account balance

What are some common Services of SBI?

State Bank of India (SBI) offers a wide range of services, including:

- Personal Banking: Integrated services including loan products, salary packages, digital loan offerings, NRI business, and wealth management.

- Savings accounts: Earn up to 4% interest on account balance with various account types.

- Loans: Low processing charges and interest rates with flexible repayment options.

- Personal Loan: Low-interest rates with repayment tenure up to 5 years.

- Car Loan: Financing options for new and used cars with low-interest rates and flexible repayment tenure.

- Gold Loan: Loan against gold ornaments with affordable interest rates.

- Education Loan: Financial assistance for students pursuing higher education.

- Credit Cards: Various credit card options with rewards, cashback, and lifestyle benefits.

- Debit Card: Flexible withdrawal limits, rewards on shopping, and travel benefits.

Investment services - Corporate Banking: Corporate banking provides financial services and products to businesses and corporations, helping them manage their finances, investments, and transactions.

- Cash management: Cash management refers to the process of managing a company’s cash flow, including collecting, disbursing, and investing cash to ensure liquidity and optimize financial performance. SBI’s cash management services help businesses efficiently manage their cash flows, payments, and collections.

- Trade finance: SBI’s trade finance services help businesses manage trade-related risks, improve cash flow, and facilitate smooth transactions.

Treasury services: Treasury services involve managing a company’s financial assets, investments, and risks, helping businesses optimize their financial performance and liquidity. - Investment Banking: Investment banking provides financial services like raising capital, advisory on mergers and acquisitions, and managing financial transactions for corporations and governments.

- IPO advisory: IPO advisory refers to expert guidance provided to companies on Initial Public Offerings (IPOs), helping them navigate the process of going public, including valuation, regulatory compliance, and share pricing.

- Merger and acquisition advisory: Merger and acquisition advisory provides expert guidance to companies on buying, selling, or merging with other businesses, helping them navigate complex transactions and achieve strategic goals.

- Debt syndication: Debt syndication is a process where multiple lenders come together to provide a loan to a borrower, sharing the risk and allowing for larger loan amounts.

- Digital Banking: YONO (a digital banking platform for managing accounts, applying for loans, and making transactions online)

- Custody and Fund Accounting Services:

SBI-SG Global Securities Services provides custody and fund accounting services for international and domestic investors, with expertise in cross-border transactions and robust risk mitigation strategies - Securities Services:

Custody services for various asset classes, including equities, bonds, and derivatives

Fund accounting and administration services

Securities lending and borrowing - Insurance Services: Insurance provides financial protection against unforeseen events, such as accidents, illnesses, or property damage, offering peace of mind and financial security to individuals and businesses. SBI offers various insurance products, including life and general insurance.

- Mutual funds Services : Mutual funds are investment vehicles that pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities, offering a way to invest in a broad range of assets with professional management.

- NRI Services : NRI services provide banking solutions for Non-Resident Indians (NRIs), including accounts like NRE (Non-Resident External) and NRO (Non-Resident Ordinary), as well as services like online banking, fund transfers, and investment options. SBI offers various services to cater to the financial needs of NRIs.

- Agriculture and Rural Banking Service : Agriculture and Rural Banking provides financial services to farmers and rural communities, including crop loans, farm equipment financing, Kisan Credit Cards, and other products tailored to support agricultural activities and rural development. SBI’s services aim to boost agricultural productivity and improve the financial well-being of rural customers etc.

Conclusion:

State Bank of India (SBI) offers a wide range of financial services.These include personal banking with various account options and digital services. Corporate banking is another key area, providing working capital finance, term loans, and trade finance. Treasury services involve managing financial assets, investments, and risks.

Investment banking provides services like IPO advisory, merger and acquisition advisory, and debt syndication. Insurance products offer financial protection. Mutual funds allow investment in diversified portfolios. NRI services cater to non-resident Indians with specialized banking solutions. Agriculture and rural banking support farmers and rural communities with financial products tailored to their needs.

Each of these services is designed to meet specific financial needs, contributing to SBI’s role in India’s economic development. The bank’s extensive network and customer-centric approach enable it to serve a broad customer base effectively.